888Holdings Announces FY23 Financial Results and Unveils Strategic Value Creation Plan

Published: March 26, 2024 | Author: Ron Clarke

888Holdings, a leading global player in the gaming sector and owner of top gaming brands William Hill, 888 Casino, 888 Poker and Mr Green, has released its financial results for the fiscal year ending December 31, 2023. The company has also launched an ambitious Value Creation Plan (VCP) aimed at steering the company towards long-term success and sustainability.

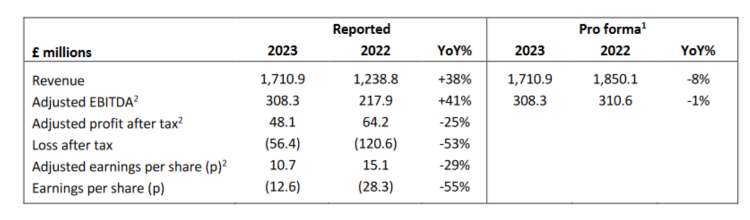

The company’s 2023 revenue saw a 38% increase compared to the previous year to £1,710.9 million, although on a pro forma basis, there was a slight 8% decline compared to 2022. The Adjusted EBITDA saw a 41% increase, reaching £308.3 million, with the margin expanding to 18.0% from 16.8% in FY22.

Despite these strong performance indicators, the company faced a reduction in its adjusted profit after tax, which stood at £48.1 million, a 25% decrease from the prior year. The loss after tax showed a significant improvement, decreasing to £56.4 million from £120.6 million in 2022. This reflects the company’s focused efforts on cost management and operational efficiencies.

Aiming to enhance its financial performance, 888Holdings introduced its Value Creation Plan, spearheaded by the newly appointed CEO, Per Widerström. The plan outlines a series of strategic initiatives designed to optimize operational excellence and propel the company towards significant value creation. Among the key moves is the restructuring of the executive team to harness expertise and experience for effective execution of the company’s strategies.

The new plan also emphasizes the importance of operational efficiency, with the company targeting approximately £30 million in annual cost savings by eliminating redundancies and enhancing accountability. Furthermore, the plan includes a strategic reevaluation of the US B2C business and and proposes to change of the group’s name from 888Holdings to Evoke plc in order to better illustrate its multi-brand operating model and its vision and mission.

Looking forward, 888Holdings has set ambitious medium-term targets under the VCP, including a 5-9% annual revenue growth, an approximate 100 basis points yearly expansion in Adjusted EBITDA margin, and a leverage reduction to below 3.5x by the end of 2026. The company anticipates Q1 2024 revenue to be in the range of £420-430 million, with a positive outlook for the rest of FY24.

This comprehensive approach demonstrates 888Holdings’ commitment to sustainable growth and hopefully positions the company favorably in a competitive market landscape. With a clear strategic direction and a focus on leveraging its core strengths, 888Holdings hopes to deliver on its promise of long-term success and profitability.